Duty & Tax Calculation

Accuracy and transparency with duty and tax calculations drive greater customer retention.

Make DUTY AND TAX simple with Hurricane API

Every product has a duty and tax rate applied to it on importation, with the rates differing from country to country. Each country has its own low value threshold(s) – the value(s) at which goods do not have any duty or taxes applied to them.

Hurricane’s Solutions

Hurricane provides a real time duty and tax calculation, taking actual trade agreements, duty and tax thresholds and rates applied by the importing customs into consideration.

DUTY AND TAX CALCULATOR

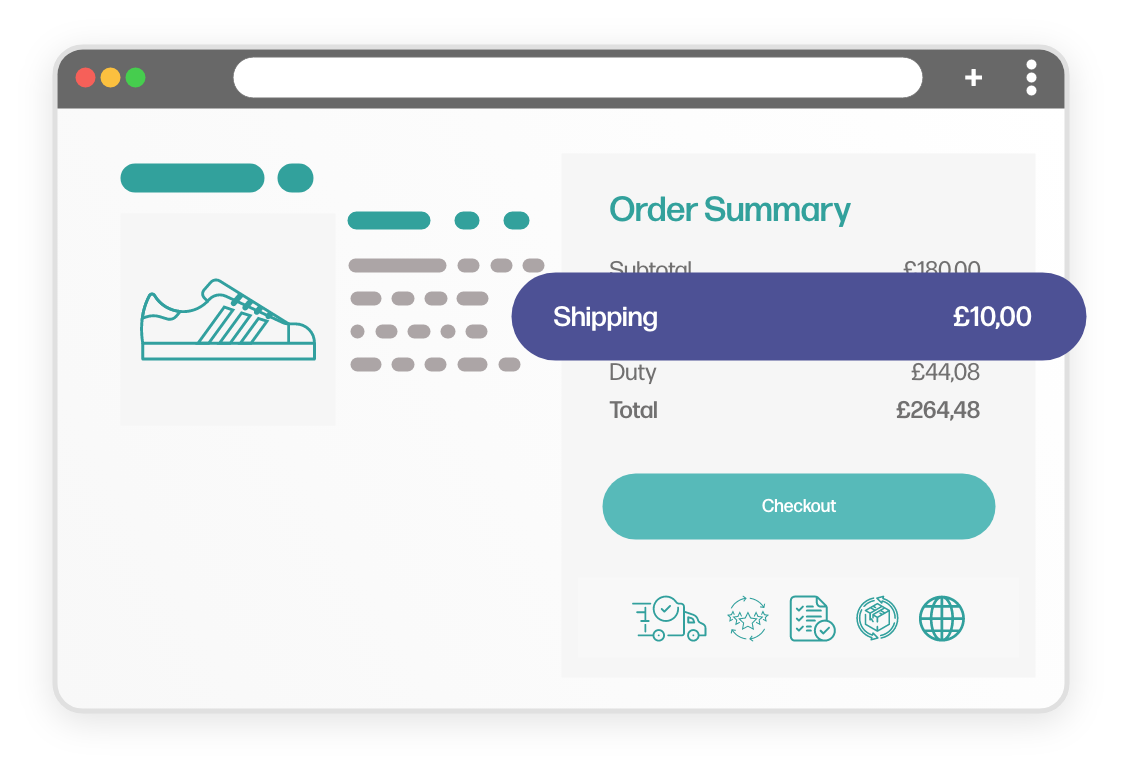

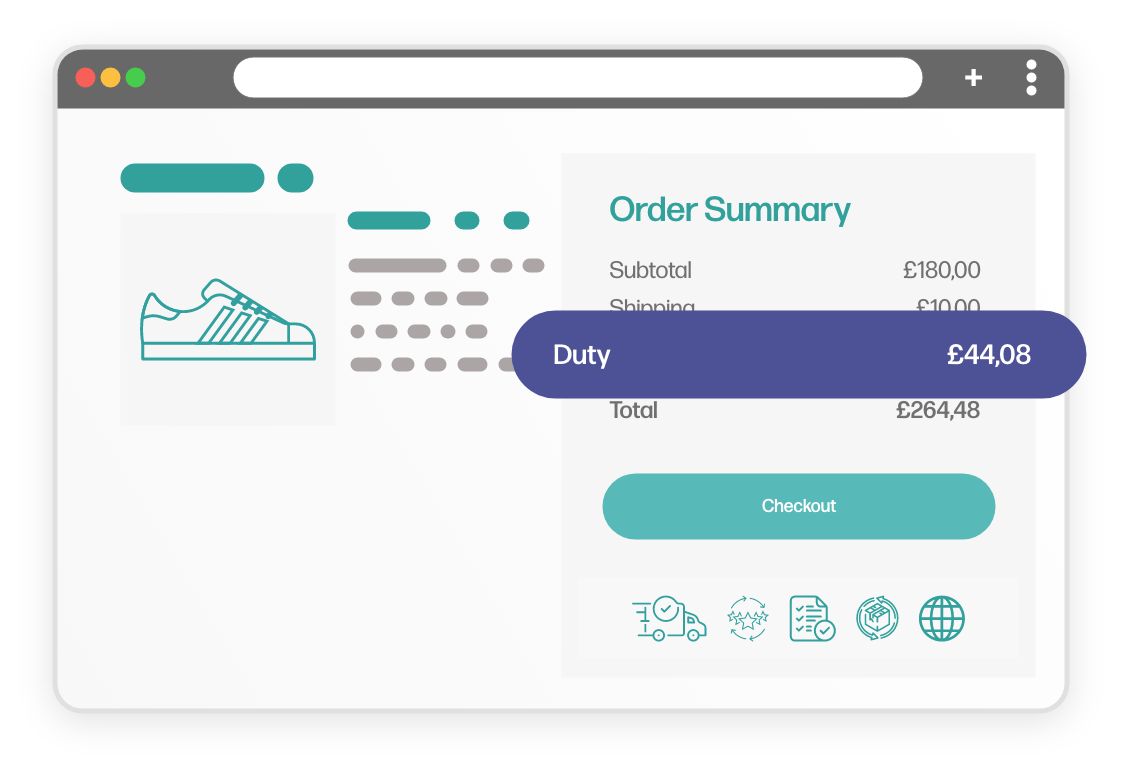

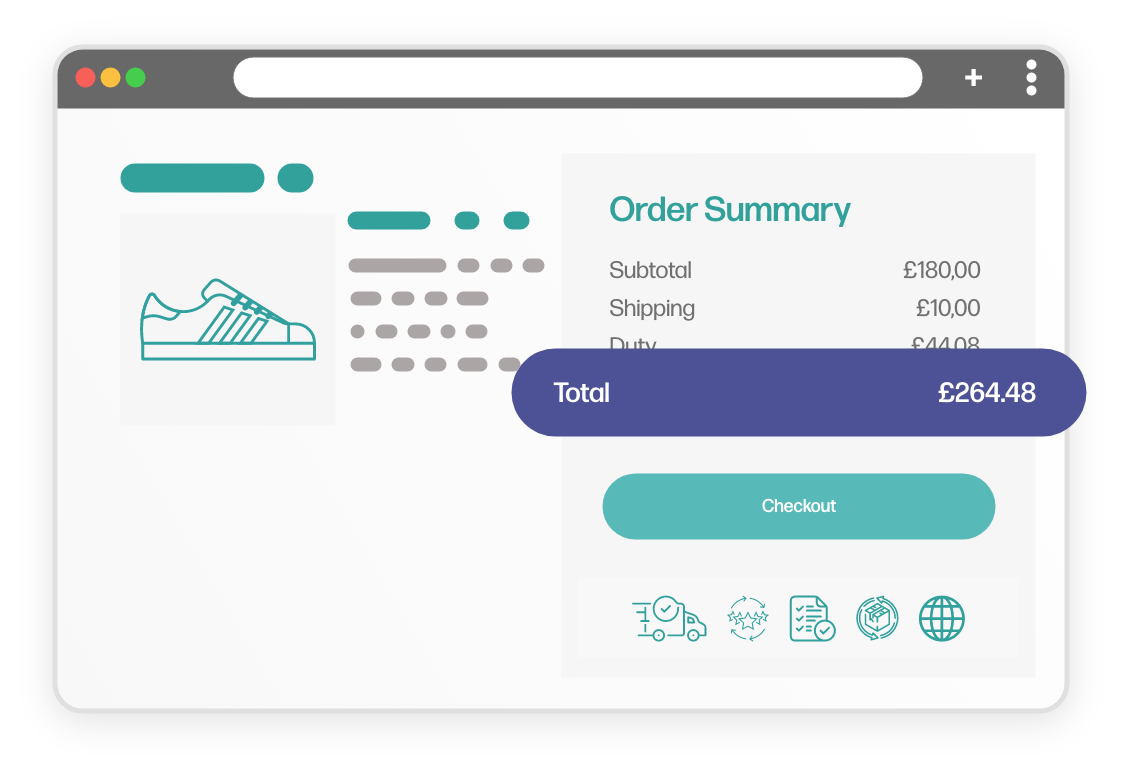

The Hurricane Duty and Tax Calculator calculates the duty rate, tax rate, duty payable and tax payable in the currency of the sending or receiving country.

Providing a Full Landed Cost and being transparent with customers can positively affect the behaviour of cross-border customers.

Delivered DUTY PAID (DDP)

Cost transparency and/or the implementation of Delivered Duty Paid (DDP) solutions leads to the reduction of cart abandonment and customer service enquiries, and an increase in repeat sales.

KEY

TAKEAWAYS

Paying the correct duty and taxes is vital for any retailer

Shoppers would rather know about duty and taxes upfront – and avoid ‘doorstep shock’

Accurate landed cost leads to better customer experience and repeat orders.

Our other Solutions

OUR LATEST NEWS

Keep up to date with what we’re up to.

Hurricane and Plusius Combine Data and Finance to Power the Future of Global Trade

Hurricane and Plusius Combine Data and Finance to Power the Future of

Virgin Money refinances Hurricane Modular Commerce with £2.25 million venture debt facility to accelerate global growth

For immediate release Virgin Money Refinances Hurricane Modular Commerce with £2.25M Venture

Why Hurricane is Still Relevant When You Can Try and Build Your Own Classification Engine with GPT4?

Why Hurricane Is Still Relevant When You Can Try To Build Your