Import One Stop Shop (IOSS)

Fulfill low-value EU shipments with ease

Hurricane makes it easy to clear low-value shipments to the EU and remit taxes to the proper authorities.

What is IOSS

The Import One-Stop Shop (IOSS) is the import scheme for EU and non-EU businesses introduced in July 2021.

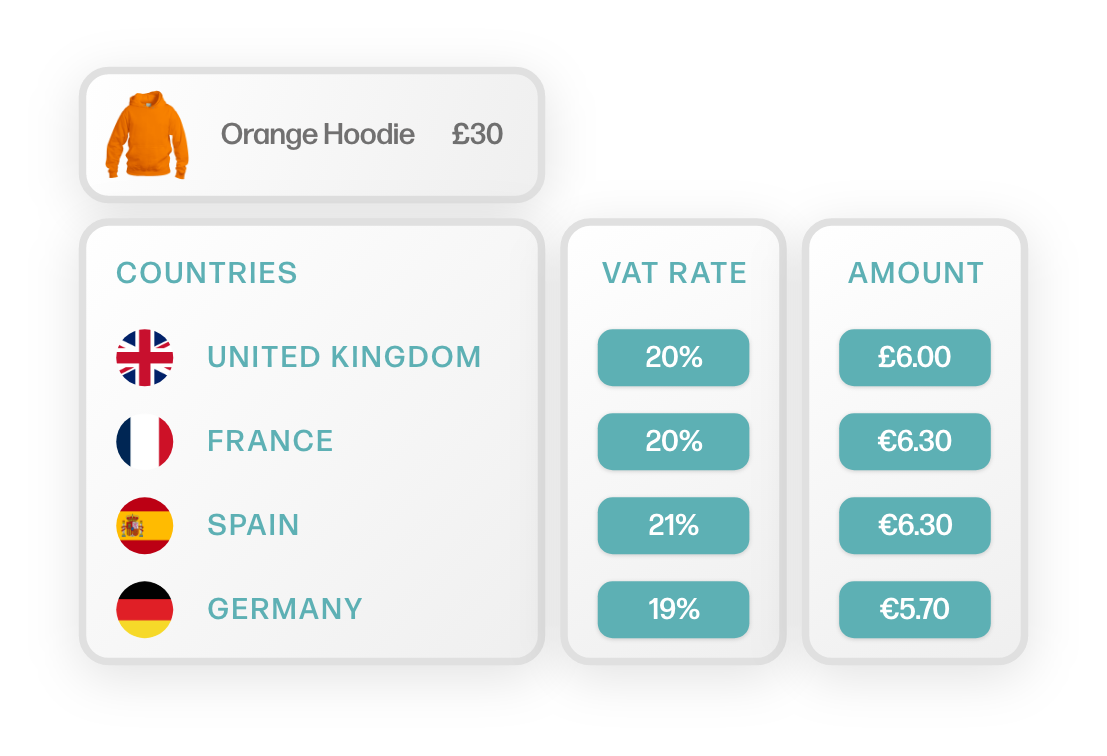

Businesses are able to sell goods with a value up to €150 to EU consumers, paying VAT in a single monthly VAT return.

As of July 1, 2021, goods with a value of up to €22 are no longer VAT exempt when imported into the EU.

When the IOSS is used, VAT will have been charged and collected when the payment of goods has been accepted.

It means that goods arriving at the EU border will benefit from a quick release at customs.

Consignments with a value over this amount will be cleared in the traditional way with VAT and Duty paid via the usual methods.

The UK introduced a similar system which was applicable from Brexit Day – January 31, 2021.

The UK withdrew the EU £15 low-value consignment threshold on this date and introduced a new £135 VAT parcel regime – similar to the EU’s €150 IOSS scheme.

Non-EU retailers may already register with the UK’s HMRC so they are prepared to start declaring UK import VAT.

The IOSS is not compulsory for consignments under €150. The retailer/marketplace may still choose to collect the import VAT from the recipient by the postal operator, courier firm or customs agent.

This will result in a more complex customs clearance procedure, the payment of significant administrative fees and much longer transit times.

How do I get prepared for IOSS?

Hurricane’s AI-driven data solutions enable retailers to have the complete Advance Electronic Data (AED) that will be essential to make use of IOSS. That data includes the HS6 code and standard commodity description.

Our APIs also support with the provision of the full landed cost during checkout which is required if a retailer wants to use IOSS. Registration for IOSS can take place in any one of the EU countries, usually the country in which most of your business transactions are based.

Our other Solutions

OUR LATEST NEWS

Keep up to date with what we’re up to.

Hurricane Recognised in Deloitte EMEA Technology Fast 500

We’re thrilled to announce that Hurricane Modular Commerce has been recognised in

Global Tariff Updates

Hurricane’s data-driven APIs are updated real time in line with changes to

Hurricane Commerce Signs Agreement to Utilise SGS D-TECT®

Hurricane Commerce and SGS Partner to Revolutionise Customs Clearance with Data-Driven Compliance