Aura

Calculation and Compliance Engine (AC2E)

Successful global trade requires accurate data across three critical areas: duty & tax calculation; prohibited & restricted goods screening; and denied parties screening. These functions are integral within Kona v2 and accessed via that API.

What is it?

The Aura Engine covers three of Hurricane’s core cross-border services provided within Kona v2.

Duty & tax calculation, prohibited & restricted goods screening and denied parties screening.

Delivered Duty Paid Solution

These API services can be accessed individually or via a single combined API call within Kona v2.

Hurricane’s Kona API can be seamlessly integrated into any front end or back end.

A front-end integration allows carriers, retailers and marketplaces to offer their clients a landed cost calculation or Delivered Duty Paid solution (DDP), and also offers the possibility to flag prohibited and restricted goods and/or denied parties before shipping or even before the order is completed.

What does it do?

the ACCE provides the following solutions within Kona v2:

Manage international taxes and duties

Easy

Calculations

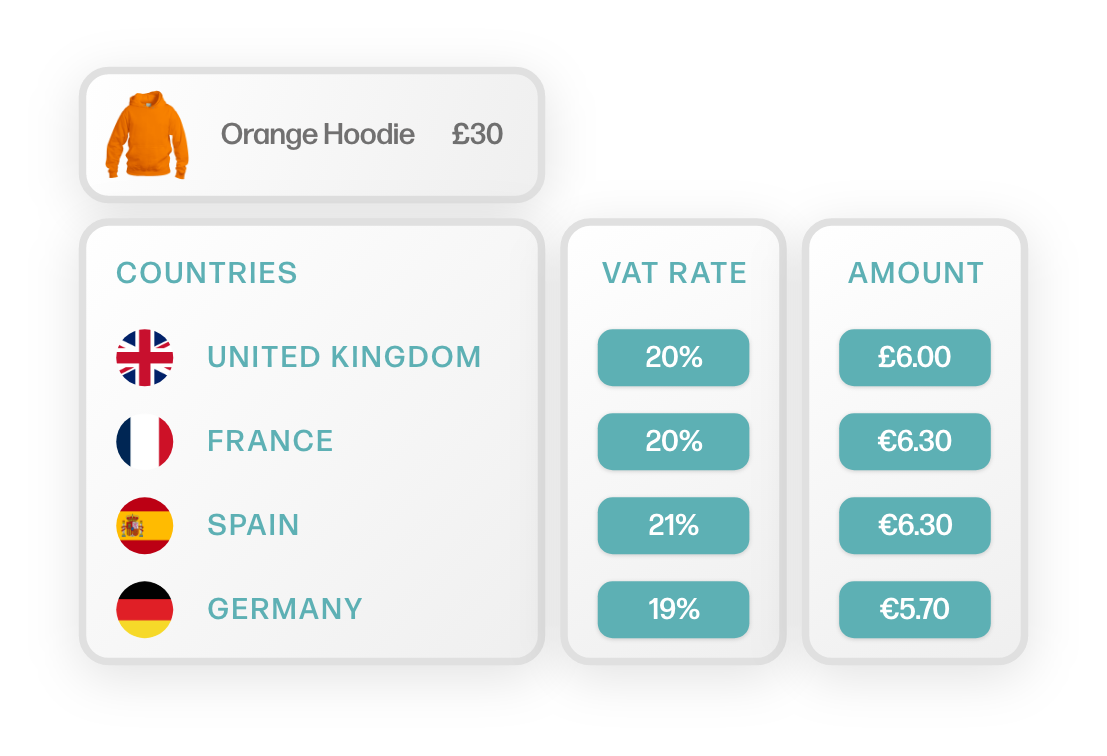

Calculates the duty rate, tax rate, duty payable and tax payable in the currency of the sending or receiving country.

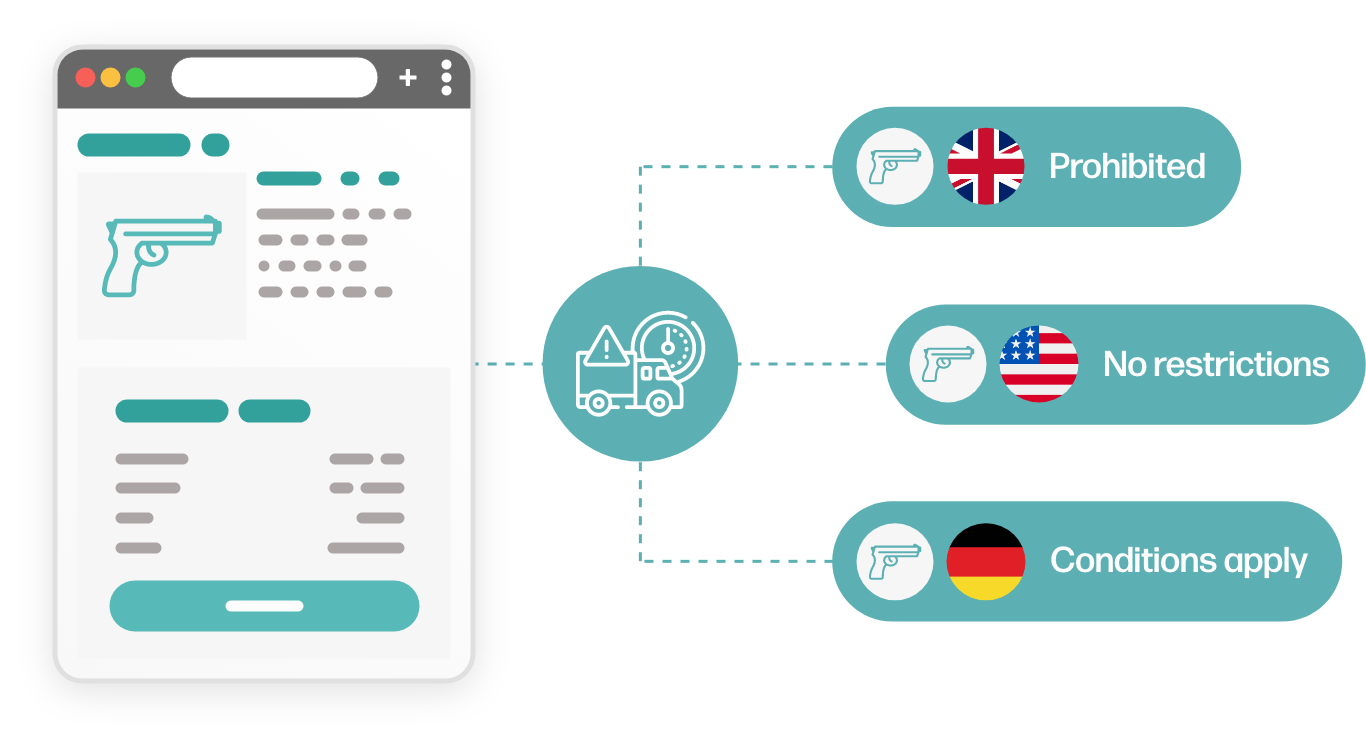

Prohibited & Restricted Items

Denied

Parties

Why is is important?

Regulatory events including the EU’s abolition of the VAT exemption on low-value items, the introduction of the EU’s Import One-Stop Shop (IOSS) and the Import Control System 2 (ICS2), as well as the Type86 requirements in USA mean that accurate duty and tax calculations and rigorous compliance screening are requirements to succeed in global cross-border trade.

Key

Features

- A key and integral part of Kona

- Currency conversion

- Multi-lingual

- Speed – a single call can take as little as 100 milliseconds

- Real-time checking on prohibited & restricted items and denied parties

Key

Benefits

- Complete transparency of cost at checkout

- Avoid fines & other penalties for non-compliance

- Reduced returns

- Improved operational efficiencies

- Enhanced customer experience

What our

Customers say

Ed Ayyad, Director of International at EVRi, said:

“EVRi is committed to providing our customers with the best possible experience and a key part of this mission is ensuring parcels are able to move seamlessly on to their final destination.

“Achieving this requires the adoption of best-in-class technology and we are therefore delighted to announce that we have chosen Hurricane to be our global strategic partner for the provision of cross-border data solutions.”

Other Products

OUR LATEST NEWS

Keep up to date with what we’re up to.

Hurricane and Alice IOT Align Compliance Intelligence with Cross-Border Parcel Orchestration

Hurricane Commerce and Alice IOT Redefine How Data Compliance Powers Cross-Border Parcel

Hurricane and Plusius Combine Data and Finance to Power the Future of Global Trade

Hurricane and Plusius Combine Data and Finance to Power the Future of

Virgin Money refinances Hurricane Modular Commerce with £2.25 million venture debt facility to accelerate global growth

For immediate release Virgin Money Refinances Hurricane Modular Commerce with £2.25M Venture